The Ultimate Guide to Touch 'n Go App's Invest Your Money Feature

Investing is a vital step towards achieving financial independence, and the Touch 'n Go (TNG) app democratizes access to various investment options, making it easy for everyone to get started. This ultimate guide will delve deep into the minimum investment values associated with different investment types available via the app, focusing on how low barriers to entry can facilitate wealth-building for Malaysians. With investment options starting from as little as RM10 and flexible auto cash-in features, you can effectively plan for rainy days and retirement.

1. Understanding E-Trade: Your Gateway to Stock Market Investment

The E-Trade option available in the Touch 'n Go app allows you to directly access stock markets with ease. Here’s a detailed look at its mechanisms and benefits:

Real-Time Trading: You can buy and sell shares instantly, with access to real-time market data and trends. This feature gives you a competitive advantage, allowing you to make swift decisions based on market movements.

Low Cost, High Value: E-Trade operates with low brokerage fees, making it a cost-effective solution for trading. Minimum investment values can start at RM10, enabling you to engage in fractional share purchases. This approach makes the stock market accessible to individuals who may not have significant capital to invest.

Research Tools: The app provides various research tools and resources, including stock reports, news updates, and performance analysis. These features help you track your investments and stay informed about market conditions.

Support for Beginners: With guided tutorials and a user-friendly interface, beginners can navigate the E-Trade feature easily, reducing the intimidation of investing in the stock market.

E-Trade is perfect for individuals who want a hands-on approach to investing in stocks, allowing them to actively manage their portfolio while capitalising on market opportunities.

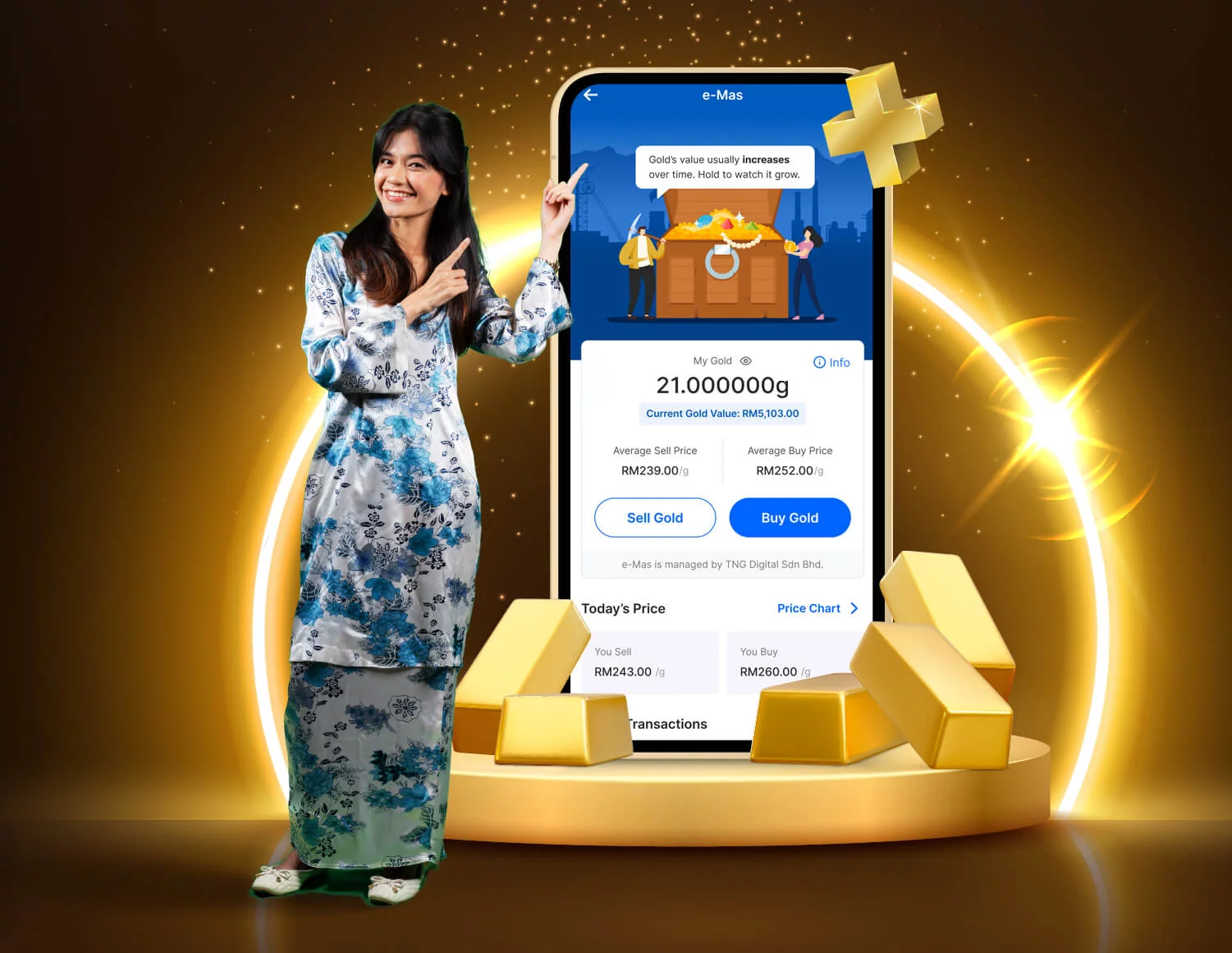

2. Gold Investments: A Timeless Hedge

Investing in gold remains a staple for those looking to hedge against economic uncertainty and inflation. The Touch 'n Go app enables users to invest in gold, providing a cushion against inflation and economic downturns. Here’s why gold investment is appealing:

Digital Gold Options: Users can purchase gold digitally, making it easy to track and manage without the logistical challenges of physical gold. This investment can typically start at RM10, facilitating ease of entry.

Inflation Hedge: Gold is historically considered a safe haven during economic downturns, preserving value when currencies fluctuate. This makes it a smart addition to your retirement portfolio.

Easy Liquidity: Gold investments can be readily converted into cash, providing quick access to funds in emergencies without significant penalties.

By incorporating gold into your portfolio, you blend stability with the potential for value appreciation—an essential aspect of a well-rounded financial plan.

3. ASNB Unit Trusts: A Trusted Tool for Financial Growth

Amanah Saham Nasional Berhad (ASNB) offers various unit trust products that cater to different investor profiles. Here’s what makes ASNB a robust choice:

Variety of Fund Options: ASNB provides over 17 unit trust options, allowing users to select funds based on their financial goals and risk tolerance. Most ASNB funds have a minimum investment of just RM10, enabling users to participate conveniently.

Capital Preservation: Many ASNB funds aim to preserve your capital, offering stable returns over the long term. For those concerned about market volatility, these funds can provide peace of mind knowing that your principal investment is safeguarded.

Accessibility and Transparency: With the TNG app, you can easily manage your ASNB investments anytime, anywhere. The app keeps you updated about your investment performance with comprehensive reports.

ASNB unit trusts are ideal for conservative investors seeking a reliable way to save for retirement or emergencies with less market risk.

4. Principal Funds: Customised Investment Strategies

Principal offers a wide array of funds catering to different risk appetites, with minimum investments typically starting at RM10. This slightly higher entry point reflects the enhanced growth potential and risk diversity that Principal funds provide. Here are the different risk profiles of Principal funds:

High-Risk Funds

Aggressive Growth Potential: These funds invest primarily in equities and aim for high returns. While they offer significant growth potential, they come with increased volatility and risk. They are best suited for young investors who can tolerate fluctuations in their investment value.

Medium-Risk Funds

Balanced Approach: These funds typically invest in a mix of equities and fixed-income securities. They provide a good balance of risk and return, making them suitable for those who want steady growth without excessive volatility.

Low-Risk Funds

Preservation of Capital: Ideal for conservative investors, these funds focus on preserving capital while providing modest returns. They are perfect for those nearing retirement or anyone looking for stability in their investment portfolio.

Principal funds enable investors to align their investment choices with their financial strategies and goals, ensuring a customised approach to wealth creation.

5. Minimum Investment Values and Auto Cash-In Features

5.1 Minimum Investment Thresholds

Across the various investment options available in the Touch 'n Go app, minimum investment values are designed to be accessible. Here’s a recap of the minimum investment values for key investment options:

E-Trade: Starts at RM10

E-Mas (Unit Trust): Starts at RM10

ASNB Unit Trusts: Starts at RM10

Principal Funds: Typically starts at RM10

Gold Investment: Generally starts at RM10

5.2 Auto Cash-In Features for Strategic Investing

The auto cash-in option in the Touch 'n Go app allows users to automate their investment contributions, which plays a crucial role in building a consistent investing habit. Here’s how it works and the benefits of this feature:

Automation: Users can set up auto cash-in intervals, whether weekly, monthly, or on a personalised schedule that suits their financial planning.

Promotes Discipline: Automatically investing at regular intervals helps cultivate a disciplined saving and investment habit, reducing the temptation to spend what you had planned to invest.

Dollar-Cost Averaging: By investing regularly, you take advantage of varying market conditions, thereby reducing the impact of market volatility on your overall investment.

Convenience: With auto cash-in, you can set your investments on autopilot, providing peace of mind and freeing up time for other aspects of your financial life.

5.3 Tailoring Your Investment Strategy

With the flexibility of auto cash-in, you can customise your investment strategy based on your financial goals:

Emergency Fund: If you aim to build an emergency fund, setting automatic contributions to low-risk unit trusts or Principal funds can ensure quick access to your capital when needed.

Retirement Savings: For long-term goals like retirement, choosing medium to high-risk funds with auto cash-ins can significantly enhance your financial trajectory over time.

6. Creating a Robust Financial Strategy

To leverage the Touch 'n Go app's Invest Your Money feature effectively, consider the following strategies to enhance your savings for emergencies or retirement:

Start Early: The earlier you begin investing, the more time your money has to grow. With options like RM10 minimums, anyone can start accumulating wealth through small, consistent investments.

Diversify Your Portfolio: Utilise the various investment options available on the TNG app to create a diverse portfolio that balances risk and return.

Utilise Market Conditions: If the market is down, it can be a good time to buy into stocks or funds, enhancing returns when the market recovers. Regular contributions help you take advantage of these opportunities.

Stay Informed: Regularly check your investments, read educational materials, and track market trends within the Touch 'n Go app to make informed decisions based on solid data.

Conclusion

The Touch 'n Go app's Invest Your Money feature breaks down barriers to investing, allowing users to embark on their financial journey with as little as RM10. With diverse investment vehicles, automation features, and the ability to monitor your investments easily, the app provides the tools needed for Malaysians to build a strong financial future. By making informed choices and setting up systematic investment plans, anyone can grow their wealth, save for emergencies, and prepare for retirement securely. Start today, and take control of your financial destiny with Touch 'n Go.